Earning adjustment statement guidance 2025 to 2026

Published 21 May 2025

Applies to England

1. Introduction and purpose of the guidance

This guidance sets out how to submit data through the earnings adjustment statement (EAS) data collection.

We may make changes to these principles and features during the funding year.

This guidance is designed for colleges, other training organisations and employers.

1.1 Understanding the terminology

The term ŌĆśweŌĆÖ refers to Department for Education (DfE). When we refer to ŌĆśyouŌĆÖ or ŌĆśprovidersŌĆÖ, this includes colleges, higher education institutions, training organisations, local authorities and employers that receive funding from us or a devolved authority (DA) to deliver education and training.

The term ŌĆśdevolved authorityŌĆÖ refers to the mayoral combined authorities (MCAs) and the Greater London Authority (GLA) that can fund adult skills fund (ASF) provision in the 2025 to 2026 funding year.

2. What is │┘│¾▒╠²EAS?

░š│¾▒╠²EAS╠²is a comma separated value (CSV) data collection. You can submit │┘│¾▒╠²EAS╠²│┘┤Ū╠²╠²to record some types of funding that you cannot report in the individualised learner record (ILR).

Under most circumstances, you should not need to submit an╠²EAS╠²as you should record your learner data in │┘│¾▒╠²ILR. However, in some exceptional cases where you cannot record data in your╠²ILR╠²to receive your funding, you can use │┘│¾▒╠²EAS. In other cases, we will require you to use╠²EAS.

We describe the circumstances when you may use │┘│¾▒╠²EAS, or are required to use │┘│¾▒╠²EAS, in this guidance.

For a complete understanding of how the funding system works in practice, please read this guidance along with the following:

- ASF╠²funding rules

- Funding rates and formula documents

- ▒▓╣│”│¾╠²DAŌĆÖs funding rules

- ▒▓╣│”│¾╠²DAŌĆÖs funding rates and formula

- advanced learner loans funding rules

- apprenticeship funding rules╠²(for starts from 1 May 2017)

- apprenticeships technical funding guide╠²(for starts from 1 May 2017)

- funding rules╠²(for apprenticeship starts before 1 May 2017)

3. Changes from the 2024 to 2025 guidance

The way you complete and submit the EAS has not changed from the 2024 to 2025 funding year.

We have updated the adjustment type PrinceŌĆÖs Trust to The KingŌĆÖs Trust.

We have added new source of funding (SOF) codes for the 3 new devolved authorities for 2025 to 2026:

- East Midlands Combined County Authority (SOF 121)

- York and North Yorkshire Combined Authority (SOF 122)

- Cornwall Council (SOF 123)

We have deleted funding line types for apprenticeship frameworks, which can no longer be certificated after 31 March 2025. See table 2 for the list of funding line types applicable this year.

4. Can I claim funding for our learners?

You can use │┘│¾▒╠²EAS╠²to adjust your funding in the following scenarios. Please consult the corresponding funding rules for further details on the eligibility for this funding through╠²EAS:

- you have learners that require ŌĆśexcess learning supportŌĆÖ above the value of ┬Ż150 a month of learning support which is generated by our calculations from╠²ILR╠²╗Õ▓╣│┘▓╣

- you have learners that require ŌĆślearner supportŌĆÖ. This is split into several subcategories of learner support within │┘│¾▒╠²EAS

- you have learners enrolled on learning aims within the KingŌĆÖs Trust team programme and are claiming additional funding to the programme rate

- we have written to you to give authorisation to make a positive ŌĆśauthorised claimŌĆÖ. If you are repaying funding, you do not need permission for negative authorised claims.

- one of │┘│¾▒╠²DAs╠²has asked or allowed you to use╠²EAS╠²to make an ŌĆśauthorised claimŌĆÖ for provision which they fund

The different types of learning you deliver, for example apprenticeships, or adult education from │┘│¾▒╠²ASF, have different eligibility for these scenarios.╠²Table 2╠²shows which types of╠²EAS╠²claims each different type of learning delivery is eligible for.

5. When must I use │┘│¾▒╠²EAS?

In exceptional cases, we may ask you to repay funding, for example following an audit. In these cases, you must enter a negative adjustment on your╠²EAS.

If you are funded for devolved╠²ASF, a╠²DA╠²may also ask you to repay funding. In these cases, you must enter a negative adjustment on your╠²EAS╠²if instructed to do so by │┘│¾▒╠²DA.

6. General guidance for creating your╠²EAS

Under most circumstances, your╠²EAS╠²should only contain funding where you have recorded your╠²ILR╠²╗Õ▓╣│┘▓╣ correctly, but we have not been able to calculate all funding from that data. You may only use your╠²EAS╠²in cases where you have recorded your╠²ILR╠²╗Õ▓╣│┘▓╣ incorrectly if you have received written approval to do so from us or from the relevant╠²DA.

│█┤Ū│▄░∙╠²EAS╠²is a cumulative return ŌĆō ▒▓╣│”│¾╠²EAS╠²you submit within a funding year should add to the contents of the previous file you submitted, unless you need to remove something to make a correction. If you do not include the contents that you previously submitted, we will recover the funding for the previous contents and only generate earnings for the contents of your current file.

│█┤Ū│▄░∙╠²EAS╠²return is not learner based, so you do not need to return a row for each learner for whom you are claiming or repaying funding. You must aggregate the funding into different categories.

You must also ensure you have supporting evidence for each claim you make.

6.1 How do I submit data on my╠²EAS?

Your submission must be a csv file, following the instructions in the next section. You must upload the CSV to the ŌĆś.

The Submit Learner Data website will produce validation reports shortly after you have submitted your file. You must check these validation reports to ensure that there are no validation errors, which would cause some or all of your file to be rejected. For more information on validation, see │┘│¾▒╠²EAS╠²╗Õ▓╣│┘▓╣ validation section.

Your file must use the format shown in │┘│¾▒╠².

Please take care to use the exact field names you see in the file ŌĆō otherwise we will reject your submission and you will not earn the funding from that file. For more information on validation, see the EAS data validation section.

You must collect all your╠²EAS╠²╗Õ▓╣│┘▓╣ together to submit as a single file.

The adjustments in your╠²EAS╠²always represent activity at the point in time when they took place. The evidence you hold for the activity, including when it happened, should match the data you record in your╠²EAS.

You only need to add rows to your file for the claims you are making in the CalendarMonth and CalendarYear when the activity took place. You do not need a row for each FundingLine or each AdjustmentType each month.

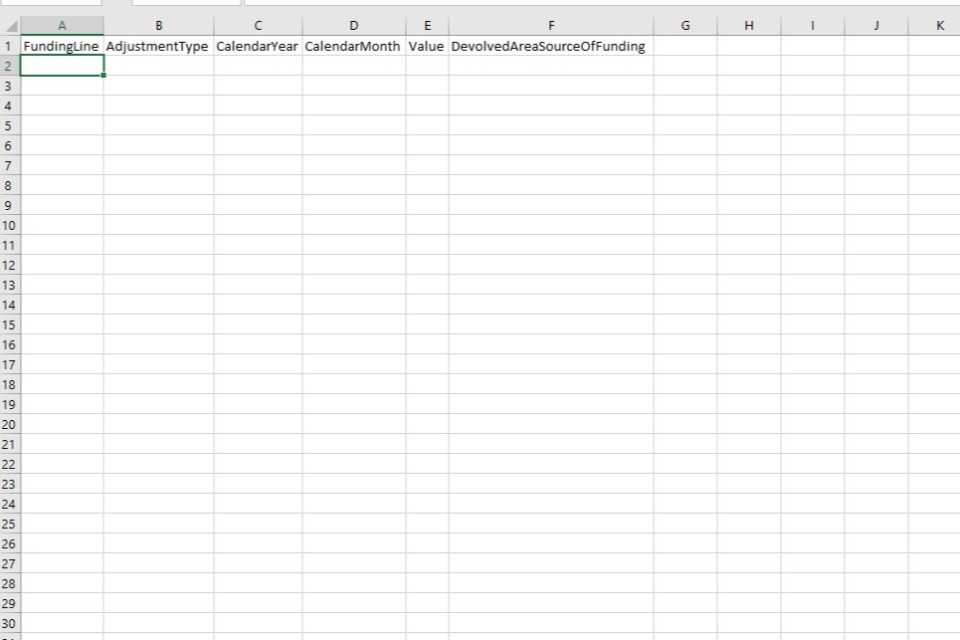

For each row in your╠²CSV╠²┤┌Š▒▒¶▒, you should use a unique combination of FundingLine, AdjustmentType, CalendarMonth, CalendarYear and DevolvedAreaSourceOfFunding, as shown in diagram 1.

Diagram 1: Example EAS file showing valid data

When you add a new adjustment, you should create a separate row of data if any one of the 5 fields above is different for that adjustment compared with existing rows in your file. If the 5 fields for an adjustment are the same as an existing row, you should amend the value in that row to reflect the total of all adjustments corresponding to those 5 fields. You only need to send a new file if there have been changes or additions since the last file you sent.

ĘĪ▓╣│”│¾╠²CSV╠²┤┌Š▒▒¶▒ you submit will overwrite the last one you submitted. Therefore, the file needs to include all the data you submit for your organisation for the current funding year ŌĆō not just the period that you are submitting data in. You must continue to submit any data you previously submitted, as this is a year-to-date collection, unless you discover an error in that data, which you must delete or correct as appropriate.

If you submit an╠²EAS╠²with a previous monthŌĆÖs data removed, we will recover any payments from you relating to that removed data. Here are some examples.

Example 1: deleting a single claim

You have submitted a row of data in your╠²EAS╠²for a ŌĆśLearnerSupportŌĆÖ adjustment in R03, but by R04 you discover the learner it was intended for had left before this claim, so you claimed the funding in error. In your R04 return, you would simply delete the row of data from your╠²EAS╠²and submit the file to delete that adjustment and repay the funding.

Example 2: deleting all your claims

You have submitted several rows of data in your╠²EAS╠²for ŌĆśLearnerSupportŌĆÖ adjustments in R03 relating to a single learner, but your╠²EAS╠²contains no other data. By R04 you discover the learner it was intended for had never started their learning, so you claimed the funding in error. In your R04 return, you would simply delete all the rows of data from your file, submitting a file containing only the field headings to delete all your adjustments and repay the funding.

If you need to change or add╠²EAS╠²values for a previous calendar month, you need to include these changes in your latest╠²CSV╠²┤┌Š▒▒¶▒ along with values for the latest month. For instance, │┘│¾▒╠²EAS╠²┤┌Š▒▒¶▒s you submit at R04 could include rows with CalendarMonths from 8 to 11, representing August to November. At R05, your╠²EAS╠²could include rows with CalendarMonths from 8 to 12, representing August to December.

The validation rules will prevent you returning data for calendar months after the month relating to the current collection.

For example, the R06 collection in the 2025 to 2026 year is open until 6 February 2026, but the latest calendar month which may be returned in an R06 EAS file is calendar month 1 (January) in calendar year 2026.

You should only return records for delivery that has taken place within the associated funding year.

For example, you can submit an EAS for the 2025 to 2026 year any time up to the close of R14 in October 2026, but it must only relate to activity that took place in the 2025 to 2026 funding year between August 2025 and July 2026.

For technical queries about submitting │┘│¾▒╠²EAS, please contact us through our .

6.2 When to submit your╠²EAS

░š│¾▒╠²EAS╠²operates within a funding year alongside │┘│¾▒╠²ILR. There are 14 ŌĆśreturnsŌĆÖ in a year where you can submit your╠²EAS, which follow │┘│¾▒╠²ILR╠²collection timetable.

- for collections R01 to R12, you must submit your╠²EAS╠²by the 4th working day of each month

- for R13, you must submit your╠²EAS╠²by 14 September 2026

- for R14, you must submit your╠²EAS╠²by 22 October 2026

If you are a grant-funded provider (ŌĆśpaid on profileŌĆÖ for │┘│¾▒╠²ASF╠²or the advanced learner loans bursary (ALLB)), your╠²EAS╠²claims will be included as part of your funding claims. You need to ensure your╠²EAS╠²claims are up to date by │┘│¾▒╠²ILR╠²return date before │┘│¾▒╠²funding claim return dates in 2025 to 2026.

- by R06 for the mid-year claim

- by R10 for the year-end claim

- by R14 for the final claim

You need to submit all╠²ILR╠²▓╣▓į╗Õ╠²EAS╠²╗Õ▓╣│┘▓╣ by the final R14 collection date so that we can calculate the correct amount to pay you for the year.

6.3 Naming your╠²CSV╠²┤┌Š▒▒¶▒

Your file must end with the .csv file extension and follow these naming guidelines for our system to accept your╠²EAS╠²▓§│▄▓·│ŠŠ▒▓§▓§Š▒┤Ū▓į:

EASDATA-LLLLLLLL-yyyymmdd-hhnnss.csv where:

- L = UK provider reference number (UKPRN) ŌĆō this must be 8 characters

- y = year at file creation

- m = month at file creation

- d = day at file creation

- h = hour at file creation

- n = minute at file creation

- s = second at file creation

6.4 EAS╠²╗Õ▓╣│┘▓╣ validation

There are 3 stages in validating a file; file level, field definition and validation rules. Each of these stages are explained below, but for further details on each stage, please refer to the EAS validation rules.

File level rules

If the file fails a file level error, then we will reject the whole file and we will report this on │┘│¾▒╠²EAS╠²rule violation report. If this happens, then we will not produce │┘│¾▒╠²EAS╠²funding report.

File level rules ensure that the format of the file and the file name are correct.

Field definition rules

The fields within a file and the accepted characters in each field are shown in table 1.

Table 1:╠²EAS╠²field definitions

| Field name | Data type | Mandatory field | Accepted data |

|---|---|---|---|

| FundingLine | Varchar | Y | Controlled value list ŌĆō see below |

| AdjustmentType | Varchar | Y | Controlled value list ŌĆō see below |

| CalendarYear | Integer | Y | 2025, 2026 |

| CalendarMonth | Integer | Y | 1 to 12 |

| Value | Decimal | Y | Made up of digits from 0 to 9, optionally one decimal point, and optionally a minus sign |

| DevolvedAreaSourceOfFunding | Integer | N | 110, 111, 112, 113, 114, 115, 116, 118, 119, 120, 121, 122, 123 or blank |

Validation rules

If any part of a record fails the validation rules, we will reject the record with an error. We produce validation warnings where the data is unusual or where the data is allowed under certain circumstances. We load records that produce warnings into the national database; however, you should check these records to ensure that the data is correct. You can access the validation rules on gov.uk.

A record within a file must be unique to pass the field definition rules. We identify this using the combination of these fields: FundingLine, AdjustmentType, CalendarYear, CalendarMonth and, for devolved╠²ASF, DevolvedAreaSourceOfFunding.

7. Field-by-field guidance for completing your╠²EAS╠²▓§│▄▓·│ŠŠ▒▓§▓§Š▒┤Ū▓į

All fields are mandatory except DevolvedAreaSourceOfFunding.

Following the guidance from the field definition validation, you should start out constructing your file as a╠²CSV, with the first row of data containing each of the listed field names, as shown in diagram 2.

Diagram 2: An EAS file with headings but no data

You should then fill out each subsequent row with data in each field that complies with each of the following sections.

7.1 FundingLine

The ŌĆśFundingLineŌĆÖ is a description of the type of learning delivery you have a contract to receive funding for. This is usually made up of an age group, a funding model and a contract type, for example ŌĆś16-18 apprenticeship non-levy contract (procured)ŌĆÖ. We validate this against the contracts you hold.

The following list shows all the FundingLines you can claim funding for and how you should enter them in your╠²EAS:

- 16-18 Trailblazer Apprenticeships

- 19-23 Trailblazer Apprenticeships

- 24+ Trailblazer Apprenticeships

- 16-18 Apprenticeship (From May 2017) Non-Levy Contract (non-procured)

- 19+ Apprenticeship (From May 2017) Non-Levy Contract (non-procured)

- 16-18 Apprenticeship (Employer on App Service) Levy funding

- 19+ Apprenticeship (Employer on App Service) Levy funding

- 16-18 Apprenticeship (Employer on App Service) Non-Levy funding

- 19+ Apprenticeship (Employer on App Service) Non-Levy funding

- 16-18 Apprenticeship Non-Levy Contract (procured)

- 19+ Apprenticeship Non-Levy Contract (procured)

- ESFA╠²Adult Skills Fund core (non-procured)

- ESFA╠²Adult Skills Fund core (procured from Aug 2023)

- ESFA╠²Adult Skills Fund free courses for jobs (non-procured)

- ESFA╠²Adult Skills Fund free courses for jobs (procured from Aug 2023)

- DA/GLA╠²Adult Skills Fund core (non-procured)

- DA/GLA╠²Adult Skills Fund core (procured)

- DA/GLA╠²Adult Skills Fund free courses for jobs (non-procured)

- DA/GLA╠²Adult Skills Fund free courses for jobs (procured)

- Advanced Learner Loans Bursary

- Short Term Funding Initiative 1

- Short Term Funding Initiative 2

- Short Term Funding Initiative 3

- Short Term Funding Initiative 4

7.2 AdjustmentType

The ŌĆśAdjustmentTypeŌĆÖ is a description of the type of additional funding you want to claim through your╠²EAS╠²that cannot otherwise by claimed on your╠²ILR.

The following table shows which AdjustmentTypes can be claimed for each FundingLine as you should enter them in your╠²EAS. Where multiple similar FundingLines are eligible for the same AdjustmentTypes, we have clustered them together.

Table 2: Valid AdjustmentTypes

| FundingLines | Valid AdjustmentTypes |

|---|---|

| ┬Ę 16-18 Trailblazer Apprenticeships ┬Ę 19-23 Trailblazer Apprenticeships ┬Ę 24+ Trailblazer Apprenticeships |

Excess Learning Support Authorised Claims |

| ┬Ę 16-18 Apprenticeship (From May 2017) Non-Levy Contract (non-procured) ┬Ę 19+ Apprenticeship (From May 2017) Non-Levy Contract (non-procured) |

Excess Learning Support Authorised Claims ŌĆō Training costs exc Maths/Eng Authorised Claims ŌĆō Additional payments for provider Authorised Claims ŌĆō Additional payments for employer Authorised Claims ŌĆō Maths and English |

| ┬Ę 16-18 Apprenticeship (Employer on App Service) Levy funding ┬Ę 19+ Apprenticeship (Employer on App Service) Levy funding |

Excess Learning Support Authorised Claims ŌĆō Training costs exc Maths/Eng Authorised Claims ŌĆō Additional payments for provider Authorised Claims ŌĆō Additional payments for employer Authorised Claims ŌĆō Additional payments for apprentice Authorised Claims ŌĆō Maths and English |

| ┬Ę 16-18 Apprenticeship (Employer on App Service) Non-Levy funding ┬Ę 19+ Apprenticeship (Employer on App Service) Non-Levy funding |

Excess Learning Support Authorised Claims ŌĆō Training costs exc Maths/Eng Authorised Claims ŌĆō Additional payments for provider Authorised Claims ŌĆō Additional payments for employer Authorised Claims ŌĆō Additional payments for apprentice Authorised Claims ŌĆō Maths and English |

| ┬Ę 16-18 Apprenticeship Non-Levy Contract (procured) ┬Ę 19+ Apprenticeship Non-Levy Contract (procured) |

Excess Learning Support Authorised Claims ŌĆō Training costs exc Maths/Eng Authorised Claims ŌĆō Additional payments for provider Authorised Claims ŌĆō Additional payments for employer Authorised Claims ŌĆō Additional payments for apprentice Authorised Claims ŌĆō Maths and English |

| ┬Ę Advanced Learner Loans Bursary |

ALLB Excess Support Authorised Claims |

| ┬Ę ESFA Adult Skills Fund core (non-procured) | Excess Learning Support Authorised Claims KingŌĆÖs Trust |

| ┬Ę ESFA Adult Skills Fund core (procured from Aug 2023) | Excess Learning Support Authorised Claims KingŌĆÖs Trust Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support IT devices and connectivity costs Learner Support Administration Expenditure |

| ┬Ę ESFA Adult Skills Fund free courses for jobs (non-procured) | Excess Learning Support Authorised Claims |

| ┬Ę ESFA Adult Skills Fund free courses for jobs (procured from Aug 2023) | Excess Learning Support Authorised Claims Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support IT devices and connectivity costs Learner Support Administration Expenditure |

| ┬Ę DA/GLA Adult Skills Fund core (non-procured) ┬Ę DA/GLA Adult Skills Fund core (procured) |

Excess Learning Support Authorised Claims KingŌĆÖs Trust Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support IT devices and connectivity costs Learner Support Administration Expenditure DA/GLA Defined Adjustment 1 DA/GLA Defined Adjustment 2 DA/GLA Defined Adjustment 3 DA/GLA Defined Adjustment 4 DA/GLA Defined Adjustment 5 DA/GLA Defined Adjustment 6 |

| ┬Ę DA/GLA Adult Skills Fund free courses for jobs ╠²(non-procured) ┬Ę DA/GLA Adult Skills Fund free courses for jobs ╠²(procured) |

Excess Learning Support Authorised Claims Learner Support 19+ Hardship Learner Support 20+ Childcare Learner Support Residential Access Fund Learner Support IT devices and connectivity costs Learner Support Administration Expenditure DA/GLA Defined Adjustment 1 DA/GLA Defined Adjustment 2 DA/GLA Defined Adjustment 3 DA/GLA Defined Adjustment 4 DA/GLA Defined Adjustment 5 DA/GLA Defined Adjustment 6 |

| ┬Ę Short Term Funding Initiative 1 ┬Ę Short Term Funding Initiative 2 ┬Ę Short Term Funding Initiative 3 ┬Ę Short Term Funding Initiative 4 |

Authorised Claims |

Excess learning support

You can claim up to ┬Ż150 of learning support a month through │┘│¾▒╠²ILR╠²to support the delivery of a learning aim.

You can claim excess learning support through │┘│¾▒╠²EAS╠²to supplement this if the cost of reasonable adjustments to deliver a learning aim exceeds ┬Ż150 a month.

For example, the monthly rate of ┬Ż150 for learning support in the ILR is enough to cover reasonable adjustment costs for a learning aim for each delivery month, except September when there is an extra one-off cost of ┬Ż100. To claim this excess, you record ┬Ż100 of excess learning support in your EAS for September.

For learning aims with a planned length of less than one calendar month, we have changed our funding calculation so that, in most cases, you should no longer need to use │┘│¾▒╠²EAS╠²to claim the learning support. However, if you see that this funding has not been reflected in your funding reports, and we expect this to be in exceptional cases only, then please claim the entire cost of the learning support through │┘│¾▒╠²EAS, instead of just the excess.

When you can claim enough learning support funding through │┘│¾▒╠²ILR, you should not use │┘│¾▒╠²EAS. We expect you to use │┘│¾▒╠²EAS╠²only when there is no alternative method to claim the funding.

For example, a learner needs support for 2 months only; ┬Ż100 in the first month and ┬Ż200 in the second month equalling ┬Ż300 in total. We expect you only to claim for 2 monthly payments of ┬Ż150 in the ILR to cover the total cost; we do not expect you to claim ┬Ż50 excess in the second month.

You can find further information on when you may claim learning support and evidence requirements in the funding rules matching the learning delivery you are claiming for.

Learner support

You can use │┘│¾▒╠²EAS╠²to claim learner support funding for procured ASF provision that we fund. DAs may also ask you to use╠²EAS╠²to claim learner support for their provision.

You should not use this adjustment type for learner support for │┘│¾▒╠²ALLB╠²(see the following section on╠²ALLB╠²excess support).

ALLB╠²excess support

You may use the adjustment type of ŌĆśALLB╠²excess supportŌĆÖ to indicate eligible learner support and excess learning support for learners with advanced learner loans.

Contract-funded providers, and providers that only hold a loans facility conditions and bursary funding agreement with us, can claim additional learner and learning support funding for learners with advanced learner loans where the fixed monthly rate does not cover the full cost of the support provided.

The monthly rate depends on the details entered in │┘│¾▒╠²ILR╠²for code ALB1, ALB2 or ALB3. You must only claim the additional funding needed each month, and you must continue to claim the standard funding rate(s) using │┘│¾▒╠²ILR.

If you are funded by a procured contract for your╠²ALLB╠²delivery, the ŌĆśALLB╠²excess supportŌĆÖ category may include a mixture of learner and learning support. You can find full details in │┘│¾▒╠²advanced learner loans funding rules.

If you are a grant-funded provider, you should only use this funding line to claim excess learning support, and not learner support, through │┘│¾▒╠²EAS. To claim your learner support, you will need to use the funding claim return directly, not your╠²EAS.

If learning support for a single learner with an advanced learner loan is greater than ┬Ż19,000 in a funding year, you must claim the excess over this amount as exceptional learning support. You can only claim this funding when we have agreed that you can submit an╠²exceptional learning support ŌĆō cost form.

Where you claim │┘│¾▒╠²ALLB, you must retain audit evidence for the overall cost of support provided, including funding earned using │┘│¾▒╠²ILR.

For further information on what you can claim, please read │┘│¾▒╠²advanced learner loans funding rules.

The KingŌĆÖs Trust

You can claim additional funding for the KingŌĆÖs Trust qualifications above the qualification rate up to the value of the programme cost. For the purpose of claiming EAS, you have to remove the apostrophe when claiming funding for The KingŌĆÖs Trust as some characters such as apostrophes can cause problems when importing or working with comma-separated value text files. For more information about the amounts you can claim, please refer to the relevant guidance from a devolved authority, or the ╠²ASF Funding Rates and Formula in Table 3.

The maximum cost you can claim through the EAS is calculated by subtracting the matrix funding rate for the aim from the maximum programme cost for the aim. This is shown as the ŌĆśmaximum additional funding forŌĆÖ in Table 3.

EAS adjustment amount = maximum programme cost ŌĆō matrix funding rate

For information on which learners are eligible, please refer to the relevant devolved rules or the Adult skills fund: funding and performance management rules.

Authorised claims

An authorised claim is a generic adjustment to funding that you may request to make, or that you may be asked to make, where funding has not been correctly paid to you.

A positive Authorised Claim may only be recorded in your EAS with the prior approval of us or the relevant devolved authority that is providing the funding. You do not need permission for a negative claim, although you may need to check with the relevant devolved authority if it relates to devolved funding.

You may need to use this adjustment type if:

- we have asked you, or you want to, repay funding to us following an audit. You must enter any repayments as a╠²negative figure╠²(-xxxx.xx)

- │┘│¾▒╠²DA╠²responsible for funding your provision asks you to use it

- the funding rules identify an exception where you can use this category

- we, or the relevant DA, give you written permission for a positive claim

We will monitor the use of this adjustment type and may ask for the evidence of authorisation if we believe we have not authorised its use.

For apprenticeship starts from May 2017, we have separated authorised claims into these 5 adjustment types:

- authorised claims ŌĆō training costs exc maths/Eng ╠²

For claims relating to training costs, excluding training in maths and English

- authorised claims ŌĆō additional payments for provider

For claims relating to the ┬Ż1,000 additional payments we make to you for younger apprentices and eligible 19 to 23 year olds

- authorised claims ŌĆō additional payments for employer

For claims relating to the ┬Ż1,000 additional payments we make to you on behalf of the employer

- authorised claims ŌĆō additional payments for apprentice

For claims relating to the first ┬Ż1,000 additional payment we make to you on behalf of the apprentice, for apprentices who are care leavers (aged up to 24 years old). The second and third instalments of the care leaver bursary will be paid to you based on continuing learning following an initial claim through either │┘│¾▒╠²ILR╠²or │┘│¾▒╠²EAS. The second and third payments must not be claimed through │┘│¾▒╠²EAS. For more information about the care leaver bursary, please refer to │┘│¾▒╠²apprenticeship funding rules

- authorised claims ŌĆō maths and English

For claims relating to training costs in maths and English

If we have identified errors in │┘│¾▒╠²FRM27 post-16 monitoring report╠²(because you recorded a withdrawal in the current╠²ILR╠²funding year, but the withdrawal date was in a previous╠²ILR╠²funding year), you can repay any funding overclaim through │┘│¾▒╠²EAS╠²in-year. You do not need our permission to do this. However, you must provide us with the following details of the learners this repayment applies to through our╠², selecting the ŌĆśDfE╠²returns and data requestsŌĆÖ option:

- academic year

- reporting month

- query ID

7.3 CalendarYear

You must record the calendar year when the activity took place that this adjustment relates to. This could be different to the year you submit the data but must be within the current funding year. It should be 4 digits, for example 2025.

7.4 CalendarMonth

You must record the calendar month when the activity took place which this adjustment relates to. This could be different to the month you submit the data but must, in combination with the CalendarYear, be within the current funding year. It should be up to 2 digits long, for example 5 for May or 12 for December.

7.5 Value

You need to enter the value of the adjustment being claimed using numbers and a decimal point only. You can record a positive number, for example 45.24, or negative number, for example -12.79.

7.6 DevolvedAreaSourceOfFunding

You must record a value in this field if you have recorded a FundingLine of ŌĆśDA/GLA╠²Adult Skills Fund core (non-procured)ŌĆÖ, ŌĆśDA/GLA╠²Adult Skills Fund core (procured)ŌĆÖ, ŌĆśDA/GLA╠²Adult Skills Fund free courses for job (non-procured)ŌĆÖ or ŌĆśDA/GLA╠²Adult Skills Fund free courses for job (procured)ŌĆÖ.

For any other FundingLine, you must leave this field blank.

You must record the source of funding (SOF) code of the devolved area for which you are recording an earnings adjustment, using the same definitions of╠²SOF╠²codes as we use in │┘│¾▒╠²ILR╠²specification for 2025 to 2026.

For example, if you are claiming an authorised claim for a learner from Greater Manchester, then you would enter ŌĆś110ŌĆÖ into this field.

For provision that we fund, you should not use │┘│¾▒╠²SOF╠²code 105 which is used in │┘│¾▒╠²ILR╠²to represent adult provision that we fund. Instead, you should leave this field blank and use one of the FundingLines which represent our funding.

Below is a list of valid SOFŌĆÖs in this field, and the devolved area they represent. In 2025 to 2026 there are ╠²new SOF codes for the 3 newly devolved authorities in 2025 to 2026 for the East Midlands Combined County Authority (SOF 121), York and North Yorkshire Combined Authority (SOF 122) and Cornwall Council (SOF 123).

Table 3:╠²SOF╠²codes for │┘│¾▒╠²DA╠²they represent

| SOF╠²code | Devolved authority |

|---|---|

| 110 | Greater Manchester Combined Authority |

| 111 | Liverpool City Region Combined Authority |

| 112 | West Midlands Combined Authority |

| 113 | West of England Combined Authority |

| 114 | Tees Valley Combined Authority |

| 115 | Cambridgeshire and Peterborough Combined Authority |

| 116 | Greater London Authority |

| 118 | South Yorkshire Mayoral Combined Authority |

| 119 | West Yorkshire Combined Authority |

| 120 | North East Mayoral Combined Authority |

| 121 | East Midlands Combined County Authority |

| 122 | York and North Yorkshire Combined Authority |

| 123 | Cornwall Council |

8. When will you pay us?

We pay you monthly in arrears for all provision except devolved╠²ASF. We will add the extra funding you claim through │┘│¾▒╠²EAS╠²to your╠²ILR╠²earnings. We will pay you each month at a contract level. To understand how╠²DAs╠²will pay you for your devolved╠²ASF╠²provision claimed through╠²EAS, please consult their documentation.

We will make payments for R01 to R12 each month from September to August. We make R13 and R14 payments later in the year, depending on the FundingLine.

9. How much have I earned or repaid?

Once you submit a file successfully, we will generate 2 EAS specific reports for you from R01:

- EAS Rule Violation Report (CSV) ŌĆō this will show you any records with errors or warnings, for example, ŌĆ£The CalendarMonth must be in numbers, not lettersŌĆØ

- EAS Funding Report (CSV) ŌĆō this will show you all rows in your report that have passed validation, and consequently you may receive funding for

We will also produce these reports on the Submit learner data website. These show you your earnings for each funding line based on your latest submitted ILR and EAS, from DfE and from devolved authorities respectively:

- Funding Summary Report

- Devolved Adult Education Funding Summary Report

- Adult Funding Claim Report

The Funding Summary Report shows the data from the EAS under the appropriate budget line. The titles of the funding lines start with the letters ŌĆśEASŌĆÖ to distinguish them from the funding generated through the ILR. The Devolved Adult Education Funding Summary Report shows the equivalent data for your devolved adult education funding.

The funding in your Funding Summary Reports is shown by months, which relate to when you earned the funding, not when we pay you for it.

In cases where a file level validation error is encountered that prevents us processing the file further, the EAS Rule Violation Report will be the only report we produce for that submission.

You will receive no funding for data in your EAS file that fails validation. You should make every effort to resolve the errors and warnings shown in your rule violation report so that you receive all the funding you are claiming.